Cross-border payments have long been one of the biggest pain points for businesses in emerging markets, slow settlement times, high fees, compliance barriers, and fragmented systems across countries. But a new wave of fintech innovation is changing the story.

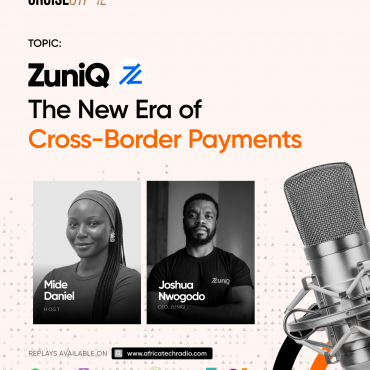

One of the startups leading this shift is ZuniQ, a fast-growing payments infrastructure company built to make international transactions for African and other emerging-market businesses faster, cheaper, and more transparent. Recently on Cruise Ctrl with Mide Daniel on Africa Tech Radio, ZuniQ’s CEO and co-founder Joshua Nwogodo broke down the challenges, opportunities, and the future of global payments.

The Problem: Why Cross-Border Payments Are So Hard for Emerging-Market Businesses

Joshua’s inspiration for ZuniQ came from a personal place, a friend in Africa constantly struggling to pay international suppliers. Transactions took days, fees were excessive, and payments often got stuck.

But this wasn’t an isolated frustration.

Across Africa and other emerging markets, businesses face structural barriers:

1. Slow Settlement Times & High Costs

One-quarter of bank-facilitated cross-border payments in Africa cost over 5% of the transaction value, far higher than global averages. For remittances above $1,000, fees often exceed 8%.

2. Limited Access to Multi-Currency Tools

Most small businesses lack access to multi-currency accounts, global liquidity channels, or modern payment infrastructures.

3. Fragmented Regulations Across Countries

What works in Nigeria might not work in Kenya or South Africa. Every country has its own compliance rules, creating bottlenecks for cross-border trade.

4. Reliance on Traditional Banks

Banks work well in developed markets, but in emerging markets, they rely on outdated processes involving multiple intermediaries, slowing down transactions and increasing costs.

ZuniQ’s Approach: Modern Payments Built for Africa

ZuniQ isn’t trying to replace banks. Instead, they are building the rails modern businesses need to thrive.

Here’s what ZuniQ does differently:

– Direct Access to Modern Financial Infrastructure

Through seamless API integrations, ZuniQ connects businesses to cashflow tools, liquidity, FX, and multi-currency accounts, all on one platform.

– Fast, Low-Cost, Transparent Transactions

Businesses see FX rates upfront, know their fees from the beginning, and can track everything in real time.

–Strong Compliance Backbone

ZuniQ is licensed in Canada, holds an AMCO license in Nigeria, and has Singapore licensing in progress.

They also maintain strict AML and KYC standards with both internal and external compliance teams.

Joshua emphasizes:

“Innovation without compliance is not sustainable, especially in cross-border payments.”

Real Impact: How ZuniQ Is Already Changing the Game

ZuniQ already processes payments for PSPs, fintechs, and businesses across different markets, powering liquidity and cross-border transactions for major operations in Africa.

One Nigerian business that previously spent days sending payments to the UK and Russia now settles transactions in as little as one hour on ZuniQ.

Using ZuniQ’s multi-currency wallet, the same business now pays suppliers in their preferred currency, cutting out unnecessary conversion costs.

Joshua describes this customer feedback as the company’s biggest motivation:

“When clients tell us they’re closing deals faster and running more efficiently, that’s what keeps us building.”

The Future: Instant, Cheaper, More Inclusive Global Payments

Joshua predicts that the future of cross-border payments will be driven by:

- Real-time settlement

- Even lower transaction costs

- Modern rails powered by stablecoins and blockchain

- Better regulatory alignment across African markets

Global giants like JPMorgan and Citi are already adopting blockchain-based payment systems. While Africa is still catching up, Joshua believes necessity will drive rapid innovation.

He sees ZuniQ as a key player in this future:

“We want African businesses to trade globally with confidence, speed, and affordability. That’s the infrastructure we’re building.”

What About Personal Payments?

For now, ZuniQ is built exclusively for businesses, not individuals.

However, they power consumer-facing payment providers from the backend, meaning you may already be using ZuniQ indirectly without knowing.

Final Thoughts

ZuniQ is part of a new generation of African fintechs rewriting how emerging markets interact with the global economy. By solving long-standing payment challenges with modern infrastructure, transparency, and compliance-first innovation, they’re helping businesses move beyond borders with ease.

As the global cross-border payments market is projected to surpass $200 trillion by 2025, one thing is clear: Emerging markets will play a crucial role, and companies like ZuniQ are paving the way.

This article is drawn from a podcast episode on Africa Tech Radio. Listen to the full interview here – https://africatechradio.com/zuniq-the-new-era-of-cross-border-payments/

Post comments (0)